|

Millions of investors are standing still right now. But their futures are not, and their financial needs are only growing.

That's why BlackRock believes it is time to look past the headlines, focus on tomorrow and become an investor again.

Courtesy of BlackRock |

| |

New York, USA - January 15, 2015

BlackRock, Inc. (NYSE:BLK)

today reported financial results for the three months and year ended December 31, 2014.

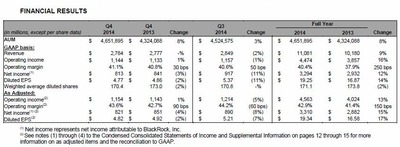

BlackRock Reports Full Year 2014 Diluted EPS of $19.25, or $19.34 as adjusted

Fourth Quarter 2014 Diluted EPS of $4.77, or $4.82 as adjusted

Record Long-term Net Inflows for Full Year and Fourth Quarter of 2014

|

Millions of investors are standing still right now. But their futures are not, and their financial needs are only growing.

That's why BlackRock believes it is time to look past the headlines, focus on tomorrow and become an investor again.

Courtesy of BlackRock |

| |

BlackRock Board of Directors Approves 13% Increase in Quarterly Dividend Per Share to $2.18 and Authorizes Repurchase of an Additional 6 Million Shares under Existing Share Repurchase Program.

8% AUM growth from the fourth quarter of 2013

$181.3 billion of long-term net inflows for 2014 and $87.8 billion for the fourth quarter of 2014

16% (13% as adjusted) operating income growth for 2014 and 1% growth from the fourth quarter of 2013

40.4% (42.9% as adjusted) operating margin for 2014 and 41.1% (43.6% as adjusted) for the fourth quarter of 2014

Consistent capital management with $250 million of quarterly share repurchases, aggregating $1 billion for the year

13% increase in quarterly cash dividend to $2.18 per share of common stock, payable March 24, 2015 to shareholders of record at the close of business on March 6, 2015

|

Laurence D. Fink, Chairman and Chief Executive Officer of BlackRock, also leads the Global Executive Committee.

Photo courtesy of BlackRock |

| |

“BlackRock’s full year 2014 results demonstrate the significant investments we have made in recent years to build the depth and breadth of our global platform,”

commented Laurence D. Fink, Chairman and CEO of BlackRock.

“In an environment of heightened market uncertainty, our clients’ investment challenges are increasingly complex. Our ability to leverage active and index strategies to deliver global solutions to clients, backed by our unifying Aladdin technology platform, creates a distinct competitive advantage, and resulted in strong organic growth and consistent financial results.”

|

Aladdin® is BlackRock's central nervous system - uniting all the information, people and technology needed to manage money in real time.

It's the platform that powers the collective intelligence of our people around the globe - helping us see clearer, work smarter, and make better decisions.

BlackRock wouldn't be BlackRock without it.

Courtesy of BlackRock |

| |

“Our long-term net inflows of $181 billion in 2014, up 55% from the prior year, are the strongest annual net inflows in BlackRock’s history. In addition, our cash management business had more than $25 billion of net inflows in 2014. These results demonstrate the power of the business model that we deliberately built to perform in all market environments.”

|

Aladdin® is BlackRock's central nervous system - uniting all the information, people and technology needed to manage money in real time.

It's the platform that powers the collective intelligence of our people around the globe - helping us see clearer, work smarter, and make better decisions.

BlackRock wouldn't be BlackRock without it.

Courtesy of BlackRock |

| |

“Strong institutional results in 2014 were driven by creating and expanding partnerships with leading global institutions seeking solutions across index, active, multi-asset and alternative strategies. The breadth of our global platform enables BlackRock to design and deliver these client-centric investment solutions and to enhance our relationship with institutional clients by also offering investment advice, Aladdin analytics, and risk management and advisory capabilities.”

|

| Courtesy of BlackRock |

| |

“In Retail and iShares, we reached significant milestones in 2014, crossing $500 billion in Retail and $1 trillion in iShares assets under management. We did this by strengthening global distribution partnerships and expanding our global market share. We had 56 distinct Retail and iShares products that each generated more than $1 billion in net inflows, up from 43 such products in 2013. We captured the number one share of industry ETF flows in the US, in Europe and globally. Further highlighting our global reach, there were 13 countries where we had net inflows in excess of $1 billion in 2014, and we now manage assets in excess of $1 billion for clients domiciled in each of 41 countries.”

|

| Courtesy of BlackRock |

| |

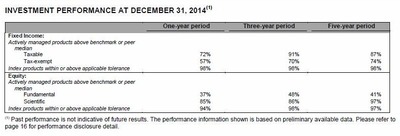

“Investment performance is the core driver of our ability to meet clients’ needs. In fixed income, BlackRock is generating consistent alpha in strategies that span geography, duration and exposure, with 91% of our active fixed income assets above benchmark or peer median for the three-year period. We also continue to make progress on the reinvigoration and globalization of our fundamental active equity business.”

|

| Courtesy of BlackRock |

| |

“I would like to thank all of our employees for their hard work and incredible dedication in 2014. Together, we remain focused on reaffirming our principles and values that drive our fiduciary duty to clients and commitment to value creation for shareholders.”

Long-Term Business Highlights

Long-term net inflows were positive across all regions, with net inflows of $61.7 billion, $14.8 billion and $11.3 billion from clients in the Americas, EMEA and Asia-Pacific, respectively.

|

| Courtesy of BlackRock |

| |

At December 31, 2014, BlackRock managed 61% of its long-term AUM for investors in the Americas and 39% for clients in EMEA and Asia-Pacific.

|

| Courtesy of BlackRock |

| |

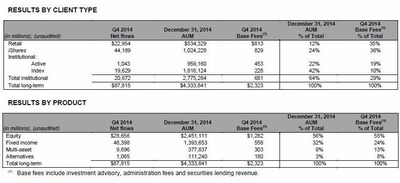

A discussion of the Company’s net flows by client type for the fourth quarter of 2014 is presented below.

Retail long-term net inflows of $23.0 billion included net inflows of $20.5 billion in the United States and $2.5 billion internationally. Net inflows were led by fixed income net inflows of $15.4 billion, which were diversified across exposures, with $4.6 billion of net inflows into the unconstrained Strategic Income Opportunities fund, $2.0 billion into the Total Return fund and $1.9 billion into the High Yield suite. The Multi-Asset Income fund family raised an additional $1.8 billion of net new assets.

iShares® long-term net inflows of $44.2 billion included equity net inflows of $24.2 billion, driven by flows into the Core Series, as well as demand for broad U.S. equity exposures. Fixed income net inflows of $20.2 billion were diversified across exposures.

Institutional active long-term net inflows of $1.0 billion were led by fixed income net inflows of $2.7 billion, primarily driven by official institutions. Multi-asset net inflows of $2.5 billion reflected ongoing demand for solutions offerings and the LifePath® target-date suite. Alternatives net inflows of $1.3 billion were led by flows into hedge fund solutions, and included the impact of $0.6 billion of capital returned to investors. Results were partially offset by equity net outflows of $5.5 billion, primarily from products with historical performance challenges.

Institutional index long-term net inflows of $19.6 billion were driven by fixed income and equity net inflows of $10.1 billion and $8.6 billion, respectively.

|

| Courtesy of BlackRock |

| |

Cash management AUM increased 5% to $296.4 billion.

Advisory AUM decreased 6% to $21.7 billion.

About BlackRock

BlackRock is a leader in investment management, risk management and advisory services for institutional and retail clients worldwide.

At December 31, 2014, BlackRock’s AUM was $4.652 trillion.

BlackRock helps clients meet their goals and overcome challenges with a range of products that include separate accounts, mutual funds, iShares® (exchange-traded funds),

and other pooled investment vehicles.

BlackRock also offers risk management, advisory and enterprise investment system services to a broad base of institutional investors through BlackRock Solutions®.

|

| Courtesy of BlackRock |

| |

Headquartered in New York City, as of December 31, 2014, the firm had approximately 12,200 employees in more than 30 countries and a major presence in key global markets, including North and South America, Europe, Asia, Australia and the Middle East and Africa.

For additional information, please visit the Company’s website at

www.blackrock.com

Twitter: @blackrock_news

Blog: www.blackrockblog.com

LinkedIn: www.linkedin.com/company/blackrock

Contact:

Tom Wojcik

Investor Relations

212.810.8127

Brian Beades

Media Relations

212.810.5596

|

| Courtesy of BlackRock |

| |

Source: BlackRock

http://www.blackrock.com/corporate/

Editor-in-Chief of ASTROMAN magazine: Roman Wojtala, PhD.