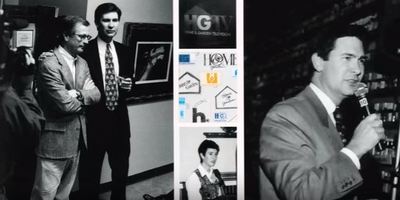

Silver Spring, Md. and Knoxville, Tenn., USA - July 31, 2017 - Discovery Communications, Inc. (Nasdaq: DISCA, DISCB, DISCK) ("Discovery") and Scripps Networks Interactive, Inc. (Nasdaq: SNI) ("Scripps") today announced that they have signed a definitive agreement for Discovery to acquire Scripps in a cash-and-stock transaction valued at $14.6 billion, or $90 per share, based on Discovery's Friday, July 21 closing price. The purchase price represents a premium of 34% to Scripps' unaffected share price as of Tuesday, July 18, 2017. The transaction is expected to close by early 2018. Combination to Accelerate Growth Across Linear, Digital and Short-Form Platforms Around the World and Create a Global Leader in Real Life Entertainment.  | (L-R) Kenneth W. Lowe, Chairman, President & CEO, Scripps Networks Interactive and David Zaslav, President and CEO, Discovery Communications.

Photo courtesy of Discovery Communications | | | Silver Spring, Md. and Knoxville, Tenn., USA - July 31, 2017

Combination to Accelerate Growth Across Linear, Digital and Short-Form Platforms Around the World and Create a Global Leader in Real Life Entertainment

• Combined company will have nearly 20% of ad-supported pay-TV viewership in the U.S.

• Becomes home to five of the top female networks in ad-supported pay-TV with over 20% share of women watching primetime in the U.S.

• Optionality for next generation growth opportunities through exploitation of brands, formats, talent and 8,000 hours of original programming annually

• Over 7 billion monthly streams creates leading short-form, mobile-first digital player

• Significant cost synergies estimated at approximately $350 million

• Expected to be accretive to Adjusted Earnings per Share and Free Cash Flow in first year after close

• Investor call scheduled for Monday, July 31, at 8:00 a.m. Eastern Time (ET)

Discovery Communications, Inc. (Nasdaq: DISCA, DISCB, DISCK) (“Discovery”) and Scripps Networks Interactive, Inc. (Nasdaq: SNI) (“Scripps”) today announced that they have signed a definitive agreement for Discovery to acquire Scripps in a cash-and-stock transaction valued at $14.6 billion, or $90 per share, based on Discovery’s Friday, July 21 closing price.

| Creating a World-Class Portfolio of Real Life Entertainment Brands.

Photo courtesy of Discovery Communications | | | The purchase price represents a premium of 34% to Scripps’ unaffected share price as of Tuesday, July 18, 2017.

The transaction is expected to close by early 2018.

| David Zaslav, President and CEO, Discovery Communications.

Photo courtesy of Discovery Communications | | | “This is an exciting new chapter for Discovery. Scripps is one of the best run media companies in the world with terrific assets, strong brands and popular talent and formats. Our business is about great storytelling, authentic characters and passionate super fans. We believe that by coming together with Scripps, we will create a stronger, more flexible and more dynamic media company with a global content engine that can be fully optimized and monetized across our combined networks, products and services in every country around the world,” said David Zaslav, President and CEO, Discovery Communications.

| Kenneth W. Lowe, Chairman, President & CEO, Scripps Networks Interactive.

Photo courtesy of Scripps Networks Interactive, Inc. | | | “Through the passion and dedication of our incredible employees, and with the support of the Scripps family, we have built a lifestyle content company that touches the lives of consumers every single day,” said Kenneth W. Lowe, Chairman, President & CEO, Scripps Networks Interactive.

“This agreement with Discovery presents an unmatched opportunity for Scripps to grow its leading lifestyle brands across the world and on new and emerging channels including short-form, direct-to-consumer and streaming platforms.”  | | Photo courtesy of Discovery Communications | | | New Innovator Across a Broad Portfolio of Entertainment Assets

Together, Discovery and Scripps will offer a complementary and dynamic suite of brands.

The combined company will produce approximately 8,000 hours of original programming annually, be home to approximately 300,000 hours of library content, and will generate a combined 7 billion short-form video streams monthly, demonstrating its commitment to delivering content as a top short-form provider.

| | Photo courtesy of Discovery Communications | | | Combined, Discovery and Scripps will have nearly 20% share of ad-supported pay-TV audiences in the U.S.

Additionally, the combined company will be home to five of the top pay-TV networks for women and will account for over 20% share of women watching primetime pay-TV in the U.S.

| | Photo courtesy of Discovery Communications | | | The Combined Portfolio’s Brands Will Include: Discovery: Discovery Channel, TLC, Investigation Discovery, Animal Planet, Science and Turbo/Velocity, as well as OWN in the U.S., Discovery Kids in Latin America, and Eurosport, the leading provider of locally relevant, premium sports and Home of the Olympic Games across Europe.

| | Photo courtesy of Discovery Communications | | | Scripps: HGTV, Food Network, Travel Channel, DIY Network, Cooking Channel and Great American Country, as well as TVN, a premiere multi-platform provider of entertainment, lifestyle and news content in Poland; UKTV, an independent commercial joint venture with BBC Worldwide; Asian Food Channel, the first pan- regional TV food network in Asia; and lifestyle channel Fine Living Network.

| | Photo courtesy of Discovery Communications | | | International Growth Opportunities

The combination will extend Scripps’ brands, programming and talent to a broader international audience through Discovery’s best-in-class global distribution, sales and languaging infrastructure.

| | Photo courtesy of Discovery Communications | | | Discovery sees strong opportunities to strengthen its existing global female networks with select content from Food Network, HGTV and all the Scripps brands.

| | Photo courtesy of Discovery Communications | | | Scripps also has a strong position in key international growth markets, including the U.K. and Poland, and will help fuel Discovery’s existing content pipeline in growth areas like Discovery’s Home and Health network in Latin America.

| | Photo courtesy of Discovery Communications | | | Social, Mobile and Non-linear Growth Opportunities

The combined company will deliver 7 billion monthly short-form streams, bringing together Scripps’ established expertise in short-form video creation with Discovery’s investment in Group Nine Media to create a new scale player with a strong ability to compete for audiences and ad dollars.

| | Photo courtesy of Discovery Communications | | | The combination will give Discovery an outstanding presence on new video and social media platforms.

Additionally, Scripps Lifestyle Studios will become a key component of Discovery’s content engine, making the company a leader in key strategic areas such as data-driven ad sales, endemic advertising, and branded entertainment solutions.

| | Photo courtesy of Discovery Communications | | | Discovery’s added scale, content engine and multiple brand offerings will present a compelling opportunity for new digital distribution partners, including mobile, OTT, and direct-to-consumer platforms and offerings.

| | Photo courtesy of Discovery Communications | | | Synergies The combination is expected to create significant cost synergies, estimated at approximately $350 million.

The deal is expected to be accretive to Adjusted Earnings per Share and to Free Cash Flow in the first year after close.

| | Photo courtesy of Discovery Communications | | | Transaction Details

Scripps shareholders will receive $90 per share under the terms of the agreement, comprised of $63.00 per share in cash and $27.00 per share in Class C Common shares of Discovery stock, based on Discovery’s Friday, July 21 closing price.

| | Photo courtesy of Discovery Communications | | | The stock portion will be subject to a collar based on the volume weighted average price of Discovery Class C Common Shares over the 15 trading days ending on the third trading day prior to closing (the “Average Discovery Price”).

| | Photo courtesy of Discovery Communications | | | Scripps shareholders will receive 1.2096 Discovery Class C Common shares if the Average Discovery Price is below $22.32, and 0.9408 Discovery Class C Common shares if the Average Discovery Price is above $28.70.

| | Photo courtesy of Discovery Communications | | | If the Average Discovery Price is greater than or equal to $22.32 but less than or equal to $28.70, Scripps shareholders will receive a number of shares between 1.2096 and 0.9408 equal to $27.00 in value.

| | Photo courtesy of Discovery Communications | | | If the Average Discovery Price is between $22.32 and $25.51, Discovery has the option to pay additional cash instead of issuing more shares.

| | Photo courtesy of Discovery Communications | | | Scripps shareholders will have the option to elect to receive their consideration in cash, stock or the mixture described above, subject to pro rata cut backs to the extent cash or stock is oversubscribed.

This purchase price implies a total transaction value of $14.6 billion, including the assumption of Scripps’ net debt of approximately $2.7 billion.

| | Photo courtesy of Discovery Communications | | | Post-closing, Scripps’ shareholders will own approximately 20% of Discovery’s fully diluted common shares and Discovery’s shareholders will own approximately 80%.

This calculation is based on the number of Discovery shares outstanding today.

The cash portion of the purchase price will be financed with a combination of new debt and cash on hand.  | | Photo courtesy of Discovery Communications | | | Discovery has secured fully committed financing from affiliates of Goldman Sachs & Co. LLC to fund the acquisition.

Discovery expects to maintain investment grade ratings throughout this transaction.

As part of its commitment to de-lever its balance sheet, Discovery intends to suspend its share repurchase program until such time as its credit metrics are in line with its rating.

Specifically, Discovery expects to be below 3.5x gross debt to AOIBDA within the first two years after the transaction closes, using substantially all free cash flow to reduce pre-payable and/or short term debt.

| | Photo courtesy of TVN in Poland | | | Mr. Lowe is expected to join Discovery’s board of directors following the close of the transaction.

The transaction is subject to approval by Discovery and Scripps’ shareholders, regulatory approvals, and other customary closing conditions.

John C. Malone, Advance/Newhouse Programming Partnership (“ANPP”) and members of the Scripps family have entered into voting agreements to vote in favor of the transaction and take certain other actions, in each case subject to the terms and conditions of their respective agreements.

In addition, ANPP has provided its consent, in its capacity as the holder of Discovery’s outstanding shares of Series A preferred stock, for Discovery to enter into the merger agreement and consummate the merger.

| | Photo courtesy of TVN in Poland | | | In connection with this consent, Discovery and ANPP have entered into an exchange agreement pursuant to which ANPP will exchange all of its shares of Series A and Series C preferred stock of Discovery for shares of newly designated Series A-1 and Series C-1 preferred stock of Discovery.

The exchange transaction will not change the aggregate number of shares of Discovery’s Series A common stock and Series C common stock that are beneficially owned by ANPP.

The terms of the exchange agreement were negotiated, considered and approved by an independent committee of disinterested directors of Discovery, which committee was advised by independent financial advisors and legal counsel.

| Creating a World-Class Portfolio of Real Life Entertainment Brands.

Photo courtesy of Discovery Communications | | | Guggenheim Securities, LLC and Goldman Sachs & Co. LLC served as financial advisors and Debevoise & Plimpton LLP served as legal advisor to Discovery.

Allen & Company LLC and J.P. Morgan Securities LLC served as financial advisors and Weil Gotshal & Manges LLP served as legal advisor to Scripps.

Evercore Group L.L.C. served as financial advisor and Kirkland & Ellis served as legal advisor to the Scripps family.

UBS Investment Bank served as financial advisor and Sullivan & Cromwell LLP served as legal advisor to Advance/Newhouse.

About Discovery Communications

Discovery Communications (Nasdaq: DISCA, DISCB, DISCK) satisfies curiosity and captivates superfans around the globe with a portfolio of premium nonfiction, lifestyle, sports and kids content brands including Discovery Channel, TLC, Investigation Discovery, Animal Planet, Science and Turbo/Velocity, as well as OWN: Oprah Winfrey Network in the U.S., Discovery Kids in Latin America, and Eurosport, the leading provider of locally relevant, premium sports and Home of the Olympic Games across Europe.

Available in more than 220 countries and territories, Discovery’s programming reaches 3 billion cumulative viewers, who together consume 54 billion hours of Discovery content each year.

Discovery’s offering extends beyond traditional TV to all screens, including TV Everywhere products such as the GO portfolio and Discovery Kids Play; over-the-top streaming services such as Eurosport Player; digital-first and social video from Group Nine Media; and virtual reality storytelling through Discovery VR.

For more information, please visit www.discoverycommunications.com About Scripps Networks Interactive

Scripps Networks Interactive, Inc. (Nasdaq: SNI) is one of the leading developers of engaging lifestyle content in the home, food and travel categories for television, the Internet and emerging platforms.

The company’s lifestyle media portfolio includes leading TV and entertainment brands HGTV, Food Network, Travel Channel, DIY Network, Cooking Channel and Great American Country.

Its digital division, Scripps Lifestyle Studios, creates compelling content for online, social and mobile platforms.

International operations include TVN, Poland’s premier multi-platform media company; UKTV, an independent commercial joint venture with BBC Worldwide; Asian Food Channel, the first pan-regional TV food network in Asia; and lifestyle channel Fine Living Network.

The company’s global networks and websites reach millions of consumers across North and South America, Asia-Pacific, Europe, the Middle East and Africa.

Scripps Networks Interactive is headquartered in Knoxville, Tenn.

For more information, please visit http://www.scrippsnetworksinteractive.com CONTACTS: Discovery Communications

Media Catherine Frymark

Catherine_Frymark@discovery.com 240-662-2934 Michelle Russo

Michelle_Russo@discovery.com +1-240-678-6375 +44-208-811-3592 Investors Andrew Slabin

Andrew_Slabin@discovery.com 212-548-5544 Jackie Burka

Jackie_Burka@discovery.com 212-548-5642 Scripps Networks Interactive

Media Dylan Jones

DJones@scrippsnetworks.com 865-560-5068 Investors Mike Gallentine

MGallentine@scrippsnetworks.com 865-560-4473  | Creating a World-Class Portfolio of Real Life Entertainment Brands.

Photo courtesy of Discovery Communications | | | SOURCE Discovery Communications

https://corporate.discovery.com/discovery-newsroom/ ASTROMAN Magazine - 2017.01.13

Scripps Networks Interactive makes leadership changes at TVN in Poland

https://www.astroman.com.pl/index.php?mod=magazine&a=read&id=2179

Editor-in-Chief of ASTROMAN magazine: Roman Wojtala, Ph.D.

|